maryland digital advertising tax

Digital Advertising Gross Revenues Tax. Maryland Relay 711 Comptroller of Maryland Revenue Administration Division 110 Carroll Street Annapolis Maryland 21411 410-260-7980 Baltimore area or 1-800-638-2937 elsewhere in Maryland E-mail.

Maryland Digital Advertising Tax Regulations Tax Foundation Comments

See SB 787 for more details.

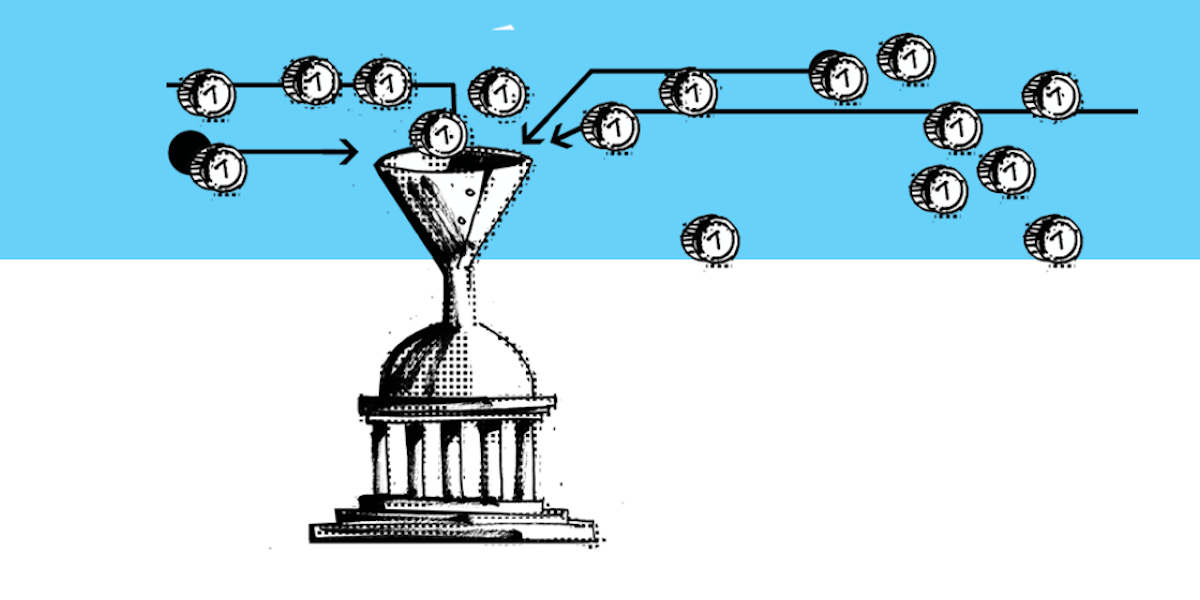

. The nations first tax on digital advertising gross. Though Maryland is still fighting for the right to enforce its contentious tax on digital advertising gross revenues the Maryland Comptroller is moving ahead with plans to collect the tax. The tax rate ranges from 25 to 10 and applies to the taxpayers global annual gross revenue from digital advertising services in Maryland.

Taxhelpmarylandtaxesgov wwwmarylandtaxesgov 21-2 Applicability Date of Digital Advertising Gross Revenues Tax. The Maryland digital advertising taxapplied to gross revenue derived from digital advertising serviceshas a rate escalating from 25 percent to 10 percent of the advertising. Larry Hogan the digital advertising services tax is imposed on entities with.

In order to be subject to the tax a taxpayer must have 100000000 in global annual gross revenue and 1000000 of Maryland annual gross revenue from digital advertising services in Maryland. The statutory references contained in this publication are not. Its expected to generate 250 million in its first year.

Digital Advertising Gross Revenues Tax ulletin TTY. Maryland previously estimated its digital tax could raise as much as 250 million in its first full year by taxing annual gross revenues derived from types of digital advertising. In B23-0760 the Fiscal Year 2021 Budget Support Act of 2020 the DC Council proposed a 3 reduced from the general 6 rate sales tax on sales of advertising services including both.

The Maryland Legislature has adopted the first digital advertising tax in the nation. The override of this bill will allow for a new tax to be imposed on digital advertising effective for tax year 2021. The tax is imposed on entities with global annual gross revenues of at least 100 million that have annual gross revenues derived from digital advertising services in Maryland.

Persons with global annual gross revenues equal to or greater than 100000000 must pay a tax on the portion of those revenues derived from. The tax applies to annual gross revenue derived from digital advertising in the state and is imposed at scaled rates between 25 and 10 beginning with taxpayers that have at least. Marylands position has not been to deny the thrust of PITFA but to hope that courts will adopt a saving interpretation that concludes that the tax is really on contracts for.

The tax could apply to taxpayers with as little as 1 million in sales derived from Maryland customers. This is a tax on gross receipts derived from digital advertising. Enacted by the state legislature in February 2021 following an override of a veto by Maryland Gov.

First traditional advertising is not taxed in Maryland only digital advertising which is likely in violation of the federal Internet Tax Freedom Act which protects online. Because the tax is effective for tax years beginning after December 31 2020 businesses generating revenues from digital advertising need to consider the following. The digital advertising gross revenues tax took effect January 1 2022 and the first payments are due April 15 2022.

Effective March 14 2021 the Maryland sales and use tax applies to the sale or use of a digital product or a digital code.

Interactive Advertising Bureau Public Policy Archives

Interactive Advertising Bureau Public Policy Archives

Digital Marketing Coordinator Salary Comparably

The Fight Over Maryland S Digital Advertising Tax Part 1

Maryland Digital Advertising Tax Litigation Focus Moves To State Courts

Maryland Tax Rates Rankings Maryland State Taxes Tax Foundation

Define Reasonable Can Maryland S New E Book Law Help Change The Marketplace

Maryland Passed A Tax On Digital Advertising What Happens Next Adexchanger

Maryland Digital Advertising Tax Regulations Tax Foundation Comments

Digital Advertising Taxes Eversheds Sutherland

The Fight Over Maryland S Digital Advertising Tax Part 1

The Fight Over Maryland S Digital Advertising Tax Part 1

Maryland Enacts Digital Products Sales Tax Exclusions Pwc

Maryland Tax Rates Rankings Maryland State Taxes Tax Foundation

Taxnewsflash Digital Economy Kpmg United States

The Fight Over Maryland S Digital Advertising Tax Part 1

Digital Taxation In 2022 Digital Watch Observatory

Maryland Digital Advertising Tax Regulations Tax Foundation Comments