tax on forex trading in south africa

Do Forex Traders Pay Tax In South Africa. SARS Pocket Tax Guide 20172018 Small Corporations.

Is Forex Trading Taxable In South Africa 2022

The South African Reserve Bank control international.

. Between Rs 1 Lakh and Rs 10 Lakh. One out of all today in 2021 is definitely eToro an Israeli online. Forex traders who are seen as South Africa Residents are required to declare all their income and profits from forex trading on their annual tax returns.

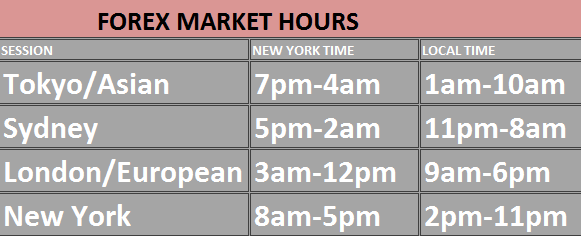

According to Keith Engel he is the CEO of the South African Institute of Tax Professionals SAIT he stated that a Forex Trader is taxed at normal rates of up to 45. Forex traders who are residing in South Africa are required to declare all their profits from forex trading on their annual tax returns. While the Forex market in this region is not a major trading hub like the four big trading sessions it is the major hub in Africa.

I say yes with certainty. A Fin24 user wants to know about tax relating to forex earnings. Simply any profits made from currency trading in South Africa is subject to income tax with forex trading being classed as a gross income.

Before this is paid all. All expenses incurred from your forex trading must be deducted from the gross income of the trading to calculate the taxable profit. Ad Empowering FX Traders In The Worlds Largest Traded Market For Over 20 Years.

Crypto Taxes in South Africa. The taxable value of. 418 Translation of foreign taxes to rand and the determination of an exchange difference on a foreign tax debt.

The income that you produce is subject to income tax. Forex traders who are seen as South Africa Residents are required to declare all their income and profits from forex trading on their annual tax returns. A maximum of Rs 180 can be charged as GST for forex transactions of up to Rs 1 Lakh.

Therefore a point of great significance. In South Africa however the top marginal personal income tax rate is 45 and top marginal capital gains tax rate is 18. Shutterstock A Fin24 user trading in forex.

South Africa has taxes on forex trading. However it is recorded that the average trader in. This is the amount that is payable as GST.

Open An Account And Start Trading Forex Like A Pro Today With The 1 US FX Broker. Once you have opened a day trading account and have a strategy you can take a position on your chosen asset such as the. Additionally it allows you to try out a 10000.

The financial markets are extremely volatile. Using FSCA regulated brokers is not. When trading futures or options investors are effectively taxed at the maximum long-term capital gains rate or 20 on 60 of the gains or losses and the maximum short.

For a 10 minimum deposit and 1 Forex South Africa Tax minimum investment you are good to go with this binary options trading platform. Investors are liable to a capital gains tax of 50 of their marginal tax rate. Trading Forex in South Africa is legal as long as you declare your income tax and you abide by financial laws that prevent money laundering.

The reason is that if you. Most forex traders however fall under the business owner category. This is strongly advisable as otherwise there might be legal consequences.

Tax implications of trading forex full time in South Africa Forex Trading tax in SouthAfrica. Forex trading which is done through a registered South African company is subject to a flat tax rate of 28 of its taxable income. How To Avoid Tax Trading forex In South Africa For tax purposes forex options and futures contracts are considered IRC Section 1256 contracts which are subject to a 6040 tax.

132 4181 Translation of foreign taxes to rand for purposes of section6. As such profits and losses are considered as. Among the best online platforms to do Forex Trading in South Africa some stand out much more than others.

Forex is legal in South Africa as long as it does. However the tax system is very. Is There Tax Payable on Forex Trading in South Africa.

It is legal to trade Forex in South Africa as the South African Government doesnt have any laws governing the legality. As a result the profit that you make from trading forex meets the defection of gross income in the Income Tax Act and thus would be taxed as income based on the income. The reason is that if you are seen as a tax resident this means that you will be taxed on all your income local and.

If you want to learn more about Cryptocurrency in South Africa and if you should pay taxes on crypto trading read further below. South Africa is no different and forex traders have to pay taxes on their profit. In South Africa forex traders make between 10000 and 45000 each d day R 15 000 R 75 000 ZAR at the time of writing.

Is Forex Trading Legal In South Africa 2022

Richest Forex Traders What Can We Learn From Leading Traders

/dotdash_Final_Why_the_Forex_Market_Is_Open_24_Hours_a_Day_Sep_2020-01-d2b1c5295a0b4d7a8df8eb057505efb3.jpg)

Why Is The Forex Market Open 24 Hours A Day

South Africa Forex License Application Tetra Consultants

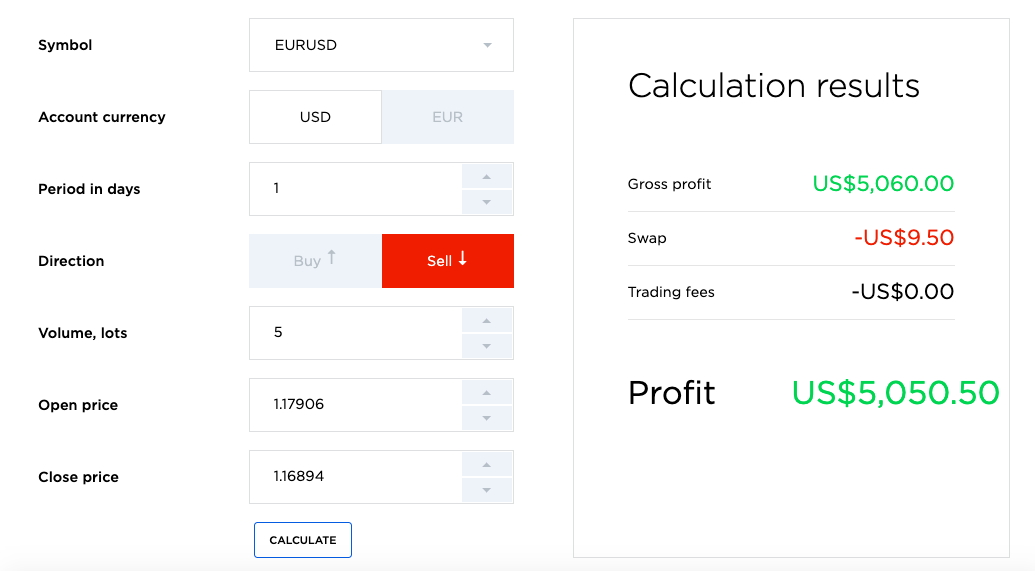

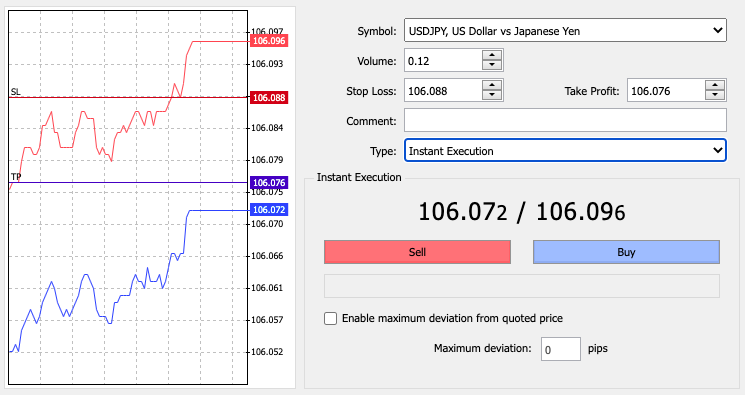

How To Trade Forex Forex Trading Examples Ig South Africa Ig South Africa

15 Best South African Brokers 2022 Comparebrokers Co

8 Most Successful Forex Traders In South Africa 2022

Forex Trading 2022 How To Trade Forex Beginners Guide

Forex Trading 2022 How To Trade Forex Beginners Guide

7 Best Forex Brokers For Beginners In 2022 Forexbrokers Com

Forex Trading In South Africa Complete Beginner S Guide 2022

Realistic Forex Income Goals For Trading

How Is Forex Trading Taxed In South Africa Khwezi Trade

Forex Trading 2022 How To Trade Forex Beginners Guide

Exclusive Forex Traders Are Required To Pay Taxes Fx Magazine Research Has Found Forex Magazine

How Do Forex Traders Pay Taxes Must Watch Youtube

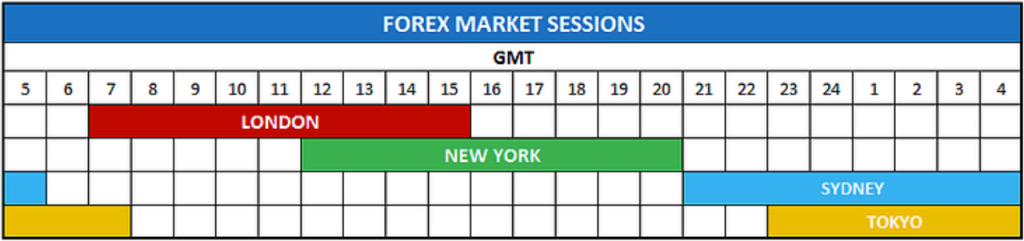

What Are Trading Sessions In South Africa Wheon